We offer adaptable limits for tools, employees' tools, specialised equipment, and hired equipment when you insure them under your electricians policy. Outside of business hours, tools must be locked up safely, and there may be a limit of one per employee.

We provide up to £2,000,000 in public and products liability coverage, up to £100,000 in professional indemnity and incidental efficacy, up to £100,000 in commercial legal coverage (including employment disputes, taxation proceedings, and contractual disputes), up to £50,000 in financial loss coverage, and up to £1,000 in coverage for jury service.

We can get you up to £10m in public and product liability insurance, and £5m in professional indemnity. In addition to safeguarding your building contracts from intentional damage while construction is in progress, we also provide coverage for employers' liability, personal accidents, tools left overnight and in transit, plant equipment and contract tasks.

Yes. Any work you do in Phase 3 is protected by your policy.

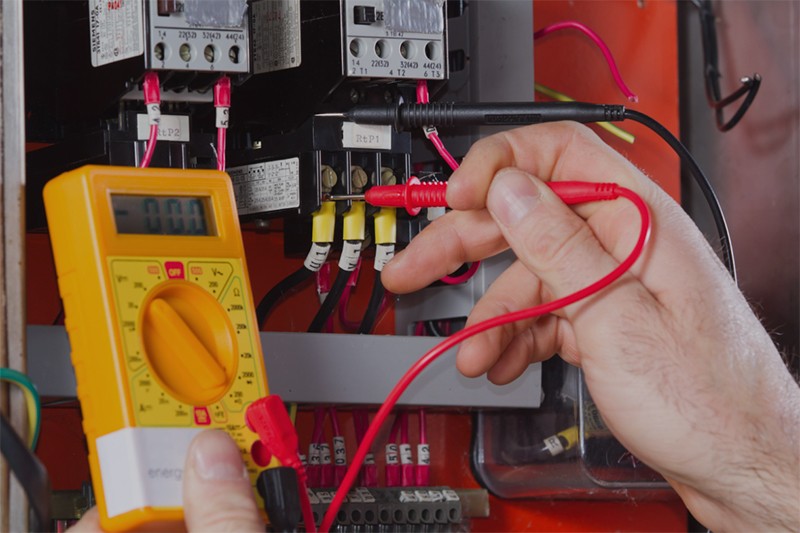

It is possible for electricians to be sued for damages to people or their property that are directly related to their employment. Before signing a contract or granting access to a location, some clients want evidence of insurance coverage. Awards from a successful lawsuit might be large, but the legal fees associated with fighting even a frivolous claim can be extremely costly. These threats are mitigated by having electricians' public liability insurance.

Your company may be unprotected from a catastrophic loss because of gaps in coverage left by some standard plans. Accordingly, a policy tailored to your business's sector is essential.

The hazards covered by your EL(Employers' Liability) cover are the same for both PAYE employees and labour-only subcontractors. The dangers you face are based in large part on the nature of the employment relationships you reveal.

Yes. You are protected up to £100,000 by our incidental efficacy cover in the event that a product or service you provided doesn't do what it's supposed to. The percentage of revenue that can be ascribed to designing, advising on, installing, maintaining, and repairing theft or fire protection equipment is capped at 15%. For a higher fee, you can get higher limitations without any caps on your turnover percentage.

We exclusively work with A-rated insurance companies since it is so crucial. It is a widely accepted indicator of an insurer's solvency and credibility in fulfilling ongoing policy commitments.In addition, some general contractors won't do business with subcontractors who don't have at least an A- financial rating on their insurance policy. Limitations on your company's ability to work with major contractors or get contracts could result from not having a policy backed by a financially stable insurer.

You can pay your premiums over the course of 10 months with our convenient direct debit plan.